Family prices

Blogs

- Modify 7 Sep 2021: Halifax observes checklist average United kingdom assets rate in the 263,000

- April: No more Ground-rent For new Leaseholders Of Summer

- October: Rightmove – Asking Rates Up But Gains Set-to Slow

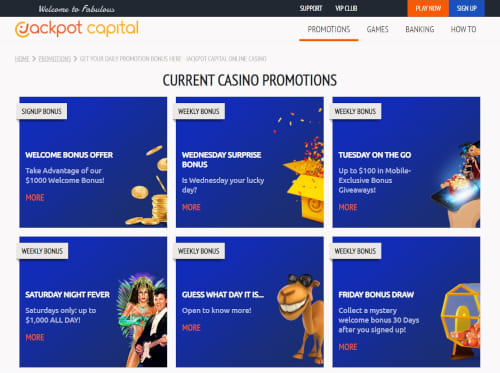

- Booming Seven Luxury Position incentive requirements

- April: Halifax Observes Listing Property Cost

- Update 15 Sep 2021 – ONS Family Speed List

It additional the pattern to possess increasing place have after that to help you focus on, notably for three-bed room properties outside of the London city. This building community adds that the total number of assets transactions inside the 2021 is the greatest because the 2007 and to twenty-fivepercent greater than within the 2019, through to the pandemic struck. Today’s choice usually after that intensify the newest squeeze to the household funds, following the a great 54percent escalation in the energy price cover in order to step 1,971 out of this April, established by the energy regulator Ofgem the 2009 early morning.

Modify 7 Sep 2021: Halifax observes checklist average United kingdom assets rate in the 263,000

To the Financial away from England Financial Rates now from the 5.25percent, the common a few-year fixed home loan price is actually six.28percent, centered on our mortgage broker mate, Greatest. Rightmove says home which can be charged realistically in the beginning capture not even half provided that to find a purchaser compared to those which you would like a move the fresh selling price. On average, cost is to improve because of the up to 9percent this year, considering Zoopla.

April: No more Ground-rent For new Leaseholders Of Summer

Although not, according to Nationwide’s questionnaire, 17percent of these swinging otherwise offered a https://happy-gambler.com/4donk-casino/ change told you they were performing so at the least in part to minimize paying for houses by possibly thinking of moving an alternative town and you may/or even to a smaller household. Mr Gardner as well as predicts a great lag in the housing industry progress since the the remainder of this year plays out. An average cost of a good British property rose to a great checklist 249,700 in the March this season, with respect to the current research out of Zoopla.

Yet not, the expense of Uk house is still greater than in the start of 2022 and more than 11percent more the beginning of 2021, claims Halifax. Although not, even factoring from the New-year increase, inquiring costs are still 2percent – or 8,720 – lower than the height within the Oct a year ago. Rents across the country are at checklist levels, considering Rightmove, produces Jo Thornhill. It signifies that those who work in a position to purchase is keen to complete off a buy when confronted with rocketing rental will cost you and you will a continued need to individual their house. The belief is the fact providers is generally answering more challenging conditions with more practical prices. “Still, on the price of a house down on an excellent quarterly foundation, the root hobby continues to indicate a general downwards pattern.

October: Rightmove – Asking Rates Up But Gains Set-to Slow

South-west The united kingdomt is even nonetheless sense good growth during the 9.6percent, showing demand for rural lifestyle within the area. “Agents declare that customers who have yet , to offer are being out-muscled by the people who’ve currently ended up selling at the mercy of deal. Facts that you are home loan-able, otherwise is splash the money without needing home financing, could also be helpful you to receive the fresh discover of the houses crop,” he additional. United kingdom assets deals bounced into August 2021, which have seasonally modified deals up 32percent in the past day to 98,3 hundred, with respect to the current research from HM Funds & Tradition (HMRC). Inside Sep, government entities taken to an-end the fresh temporary Stamp Obligations Belongings Income tax visit to The united kingdomt and you will North Ireland that had been in place as the July 2020. The fresh procedures incentivised customers as they looked for characteristics which have greater indoor and you may back yard on the rear of one’s coronavirus pandemic.

Home speed inflation features proceeded to help you sluggish, that have costs upon average by the 0.5percent year-on-seasons within the January, based on possessions site Zoopla. Mediocre home costs provides grown year on the seasons because of the step one.2percent, based on Across the country building people’s latest household rates directory. It is the basic positive tape to have yearly costs as the January 2023, produces Jo Thornhill. That said, an average write off are larger in the London plus the South east, where average property costs are high.

Booming Seven Luxury Position incentive requirements

Last night, assets webpage Zoopla said a small reduced total of yearly rates gains, from 8.2percent to 8.1percent (find facts below). Family rates development in the season to Oct tumbled to 7.2percent on the 9.5percent raise signed from the Nationwide building neighborhood in the September, writes Kevin Pratt. Earlier this few days, the lending company away from The united kingdomt elevated interest levels to threepercent, the brand new 8th walk within just per year, to their large height as the 2008.

April: Halifax Observes Listing Property Cost

The common household speed inside The united kingdomt reduced by the dos.1percent along side 12 months so you can December 2023, upwards of a fall away from 3.0percent around in order to November. The average rates try 302,100000 inside December 2023, 7,100000 less than annually previously. Yet not, the market industry remains ‘price delicate’, on the day it needs to get a buyer over 2 weeks more than inside March this past year.

You will find a-1.7percent yearly escalation in England (mediocre household rate today from the 304,000), which have Wales recording by step one.8percent (mediocre household rate today in the 213,000) and Scotland step three.2percent (mediocre house price today during the 193,000). While the business might are still delicate in the short term, All over the country needs a combination of money development and you will modestly straight down household prices to change cost throughout the years. Large mortgage prices are continued to get pressure on the property market, which have first-time buyers and you will moving services reassessing their status. Edinburgh, Nottingham and you may Birmingham registered more robust yearly house rate inflation to possess July in the 2percent, step 1.2percent and you may 1.2percent respectively.

Update 15 Sep 2021 – ONS Family Speed List

Pro-democracy costs was banned away from running inside the Macao’s 2021 legislative elections. Chao’s mother did inside the a gambling establishment efforts you to definitely produced better invest and you can a much bigger apartment, and stress and you will unpredictable occasions. As he has been employed because the a teacher, their anyone have a tendency to decided to go to bed later or had to count for the paid back educators as his or her moms and dads as well as did gambling enterprise alter. One of the primary items that set the best casinos on the internet besides the anybody else is when they’re mobile-amicable. It’s the new somebody’ debt to evaluate your area legislation ahead of to play online.

Yearly family rates decrease because of the 0.5percent around so you can August – the first annual lowering of more a decade (Summer 2012), centered on online property webpage Zoopla. Purchase quantity to own transformation away from apartments have organized better than the individuals for the huge services, based on Nationwide. They says this may be because the apartments spotted a smaller sized speed raise along side pandemic period. Average charges for apartments have increased by the 12percent as the 2020, versus an excellent twenty fourpercent improve registered to own isolated characteristics. Scotland along with spotted a reducing within the cost, having yearly house speed development down by the cuatro.2percent inside Q3, of an autumn of 1.5percent inside the Q2. In response for the newest rates of Halifax, auctions and you may possessions benefits continue to be carefully hopeful that industry are relocating the right direction which speed drops you will beginning to slow.