Common Stock What Is It, Vs Preferred Stock, Formula

Witness the process step-by-step and gain confidence in your ability to apply the formula. In the final section of our modeling exercise, we’ll determine our company’s shareholders equity balance for fiscal years ending in 2021 and 2022. From the beginning balance, we’ll add the net income of $40,000 for the current period, and then subtract the $2,500 in dividends distributed to common shareholders. There is a clear distinction between the book value of equity recorded on the balance sheet and the market value of equity according to the publicly traded stock market. If we rearrange the balance sheet equation, we’re left with the shareholders’ equity formula.

What Is Included in Stockholders’ Equity?

- Let’s say that Helpful Fool Company has repurchased 500 shares in this year’s buyback program.

- For holders of cumulative preferred stock, any skipped dividend payments accumulate as “dividends in arrears” and must be paid before dividends are issued to common stockholders.

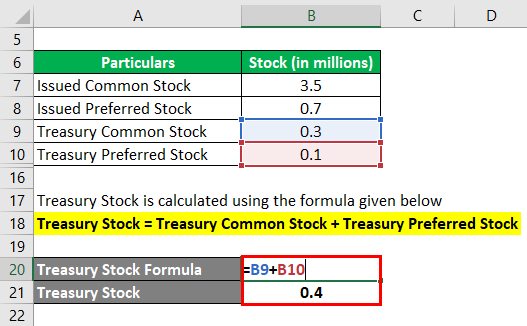

- Since repurchased shares can no longer trade in the markets, treasury stock must be deducted from shareholders’ equity.

- The investing information provided on this page is for educational purposes only.

This gives a more accurate picture of how much inventory shrinkage costs a business. This means the company still owes shareholders USD 500,000 in dividends, which will be listed under current liabilities. A lower payout ratio often indicates that the company prioritises growth, while a higher ratio might suggest a focus on returning profits to shareholders. For many, dividends offer not just a regular payout but also a way to understand the financial health and strategy of the companies they invest in. CFDs and forex (FX) are complex instruments and come with a high risk of losing money rapidly due to leverage.

Tips for Analyzing Common Stock as an Investor

Explore the concept of diversification and its role in minimizing risk. Learn how spreading investments across different assets can protect your portfolio. Here, we’ll assume $25,000 in new equity was raised from issuing 1,000 shares at $25.00 per share, but at a par value of $1.00. For example, the share is issued at the cost of $100, and its par value is $20, which means you should have a minimum amount of $20 to purchase the shares. If it is positive, it means the business will survive for a long time.

Benefits of calculating common stock on balance sheet

A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value. On the other hand, capital issued at PAR was the source of the first credit records. The second credit in the aforementioned transaction, in a similar manner, reflects the credit impact of the sum received in excess of the PAR value of the common stock. Typically, businesses use equity financing as a source to raise money for their business by issuing the company’s common stock. To put it simply, it is the acquisition of funds through the sale of business ownership.

So, when you’re thinking about investing, look at how a company handles dividends. It can tell you a lot about their financial health and how they treat their shareholders. Moreover, take note of whether the stock is callable or convertible. Callable preferred stocks can be repurchased by the issuer at a preset date and price, causing you to miss out on future dividends. Convertible preferred stock, meanwhile, can be converted into common stock at the company’s discretion, which can be an advantage if the price of the common stock rises significantly.

Active investors calculate a series of metrics to estimate a stock’s intrinsic value and then compare that value to the stock’s current market price. There are several reasons why it is important to calculate common stock on the balance sheet. When an investor gives a corporation money in return for part ownership, the corporation issues a certificate or digital record of ownership interest to the stockholder.

Inventory shrinkage is an umbrella term that businesses use to refer to inventory losses that were not part of sales. Out of those 200 units, they sell 180 but then fail to find the other twenty. It’s the ultimate checklist for year-end accounting missing inventory that a business purchased but can’t sell for various reasons, which we’ll go into more detail later. This means every shareholder receives USD 5 in dividends for each share they own.

You can do that by navigating to the company’s investor-relations webpage, finding its financial reporting, and opening up its most recent 10-Q or 10-K filing. When you buy stock in a company, you buy a percentage ownership of that business. How much of the business your one share buys depends on the total common stock outstanding, a figure you can easily determine using the company’s balance sheet. Companies may return a portion of stockholders’ equity back to stockholders when unable to adequately allocate equity capital in ways that produce desired profits. This reverse capital exchange between a company and its stockholders is known as share buybacks.

Explore how corporations authorize and calculate issued shares through market cap and balance sheet methods. Let’s say that Helpful Fool Company has repurchased 500 shares in this year’s buyback program. The company now has 5,000 authorized shares, 2,000 issued, 500 in treasury stock, and 1,500 outstanding.