4 5: Compute the Cost of a Job Using Job Order Costing Business LibreTexts

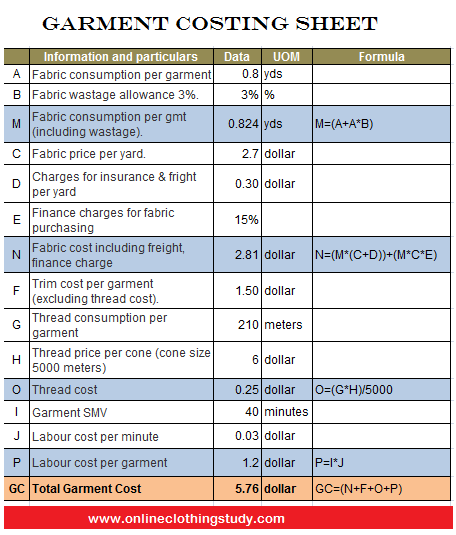

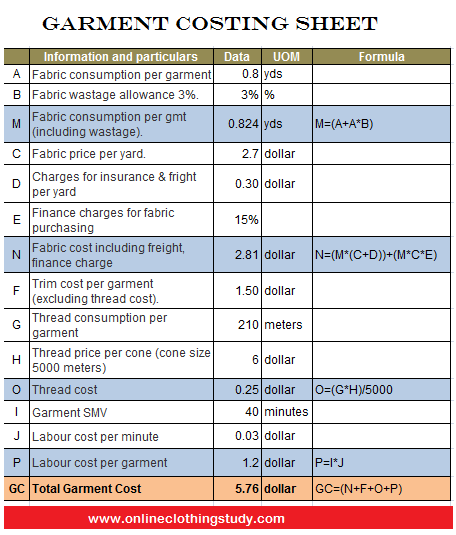

You can use these budget estimates to calculate an overhead rate to apply to each of your jobs. The total cost of a job is ascertained by posting all costs related to that job to the job cost sheet. A circulating job card is issued with each job to record the labor hours spent on different operations and the total labor cost on completion of the job.

Profit Maximization

The construction industry typically uses job order costing and accounts for its costing in a manner similar to the businesses profiled in this chapter. If a job consists of a number of units of production, the total cost of the job is divided by the number of units to calculate the cost per unit. The unit of costing, under any job costing system, is a job or specific work order. In a job costing system, each job or work order is of a specific nature. Target costing is a useful tool used in management accounting to control the cost of the products and also the desired profits required to survive the business in the long run.

Written by True Tamplin, BSc, CEPF®

Your firm has determined your applied overhead cost for the job is $8,500. There are usually different activity estimates included in your budget; opt to use the activity that applies most directly to your company’s overhead costs, for example, your estimated direct labor hours. Job costing, also called project-based accounting, is the process of tracking costs and revenue for each individual project.

Get Any Financial Question Answered

Job costing is a system in which costs are assigned to batches or work orders of production. Retail Companies – It takes a lot more than having the product on hand to run a retail business. Retailers need to factor in warehouse rent, staff wages, IT and website developers, advertising costs, and many other costs involved that require consistent monitoring to remain profitable. The following example will examine four different production jobs. Each of the four will be at beginning stages at either the beginning of the current month or the end of the current month. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Sample Cost Information for Dinosaur Vinyl

- To summarize the job order cost system, the cost of each job includes direct materials, direct labor, and manufacturing overhead.

- The job cost card must be designed to suit the needs of the organization.

- When the job is completed and overhead assigned, the overhead allocation increases the cost of the work in process inventory.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

Overhead costs are accumulated on a departmental basis and then apportioned to the various jobs executed by each department on some equitable basis (e.g., direct labor hours or machine hours spent on each job). The two main features of job costing are determining how much the cost of similar future jobs will be and improving the overall efficiency and profitability of your business through careful analysis of total costs vs. profit. Advantages the target cost for a job using job costing is calculated as: include increasing the efficiency and profitability of your business, cost control, and improving your decision-making process in future endeavors. Disadvantages include the extra work and commitment it takes and investment in new technology like payroll processing services and accounting software. The predetermined rate is a calculation used to determine the estimated overhead costs for each job during a specific time period.

Target Cost refers to the total cost of the product after deducting a certain percentage of profit from the selling price. It is mathematically expressed as the expected selling price – desired profit required to survive in the business. In this cost type, the company is a price taker rather than a price maker in the system. Most businesses create annual budgets that include estimated overhead and estimated activity for the year.

Progress reports are received from departments to assess the extent of work completed from time to time, thereby ensuring that the job is completed within the stipulated time. Engineering Firms – Labor, overhead costs, and other fees need to be taken into account, whether the engineering firm is overseeing smaller projects or multi-year site supervision and consultancy. To avoid delays in distributing overheads on an actual cost basis, overheads are generally charged at predetermined rates (i.e., the rates worked out based on the previous period’s figures). A BOM contains the details of all materials required and serves as an advanced notice to the storekeeper who may issue materials for the execution of the job on the basis of the Bill rather than on separate requisitions.

This is done to evaluate the overall profitability of the type of work that was done and to determine if there are any areas where costs could be cut in the future. The job cost sheet shows the direct material costs, direct wages, and overheads applicable to respective jobs. The job cost card must be designed to suit the needs of the organization.