4 5 Compute the Cost of a Job Using Job Order Costing Principles of Accounting, Volume 2: Managerial Accounting

Job costing is commonly used by construction companies, where costs vary widely from job to job. But it’s also used by manufacturers, creative agencies, law firms, and more. Because job costing tracks costs in detail for each job, it can be a helpful tool for small business owners to evaluate individual jobs and see if any expenses can be reduced on similar projects in the future. The total cost of your firm’s billable labor hours is $20,000 and you will bill $2,500 in material costs.

To Ensure One Vote Per Person, Please Include the Following Info

- Retailers need to factor in warehouse rent, staff wages, IT and website developers, advertising costs, and many other costs involved that require consistent monitoring to remain profitable.

- Materials required for the job are issued from the stores on the basis of a BOM or a materials requisition form.

- Advantages include increasing the efficiency and profitability of your business, cost control, and improving your decision-making process in future endeavors.

- The total cost of your firm’s billable labor hours is $20,000 and you will bill $2,500 in material costs.

- Figure 4.19 shows the flow of costs from raw materials inventory to cost of goods sold.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

What is the approximate value of your cash savings and other investments?

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. If any surplus material is returned from the job to the stores, the job account is given due credit for the value of the same. If certain special tools are required for the job, a separate list known as the tool list is also prepared.

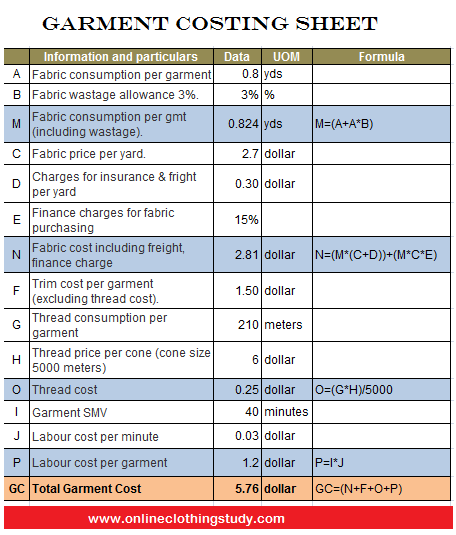

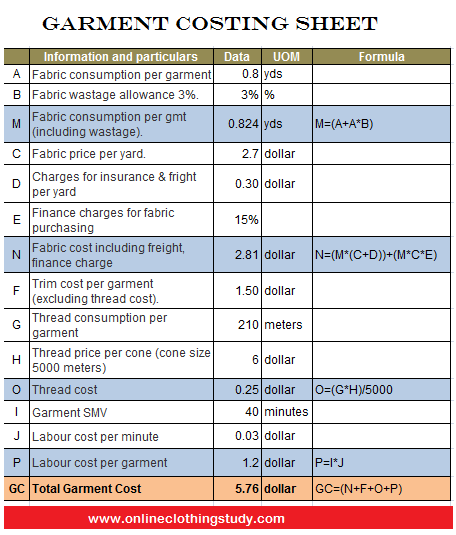

Sample Cost Information for Dinosaur Vinyl

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The BOM authorizes the foreman to call for and receive the specified materials from the stores. Thus, it serves as an authority to the foreman to indicate that the work should be started.

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with the target cost for a job using job costing is calculated as: clients large and small in the technology, financial, and post-secondary fields. Advertising Firms – Marketing and advertising costs may include rent, office supplies, computer software, utilities, internet services, and much more. Factoring the actual costs of the job into their prices will determine how much they charge to run an advertising campaign with a client.

What is job costing vs. process costing?

To summarize the job order cost system, the cost of each job includes direct materials, direct labor, and manufacturing overhead. While the product is in production, the direct materials and direct labor costs are included in the work in process inventory. The direct materials are requested by the production department, and the direct material cost is directly attached to each individual job, as the materials are released from raw materials inventory. The cost of direct labor is recorded by the employees and assigned to each individual job. When the allocation base is known, usually when the product is completed, the overhead is allocated to the product on the basis of the predetermined overhead rate.

Calculate how much it costs your business to employ all staff members who will work on the project per day. The direct labor costs calculation involves multiplying the payroll day rate by the amount of time you estimate you’ll need to complete the job. If you rely on subcontractors to complete work your company doesn’t do itself, factor those costs into your total labor costs for the job. If keeping spreadsheets and calculating labor and overhead costs feels like too much for you to do on your own, you may wish to utilize professional bookkeeping services. FreshBooks connects clients with real bookkeepers who can help you with all things accounting, from taxes to job costing.

Now that you’ve calculated your predetermined overhead rate, you can apply it to jobs for the purpose of job costing as the applied overhead cost. For each direct labor hour worked you’ll add $50 of overhead to the job. You want to use job costing in your construction business, and you’re looking to calculate your predetermined rate to use for job costing. You estimate that in 2025, you’ll have $500,000.00 in overhead costs.